Considering preowned endoscopes?

Here are 6 things Becker's Hospital Review wants you to know before you buy

Weighing value between new and preowned scopes

1. Technological advancement.

2. Upfront investment.

The cost eventually pushed the health system to explore alternatives by partnering with an ISO to repair devices.ISOs can offer preowned endoscopes for 30 to 50 percent less than OEMs. Although a preowned scope may lose some efficiency due to wear and tear, with a high-quality ISO, it should operate just as well as a new scope. “We use [an ISO] primarily as a repair depot purely because of cost,” Mr. Smith says. “The OEM is typically two to five times higher. Other than that, if it’s certified preowned and the quality is there, I see no reason not to go with the preowned scope.”

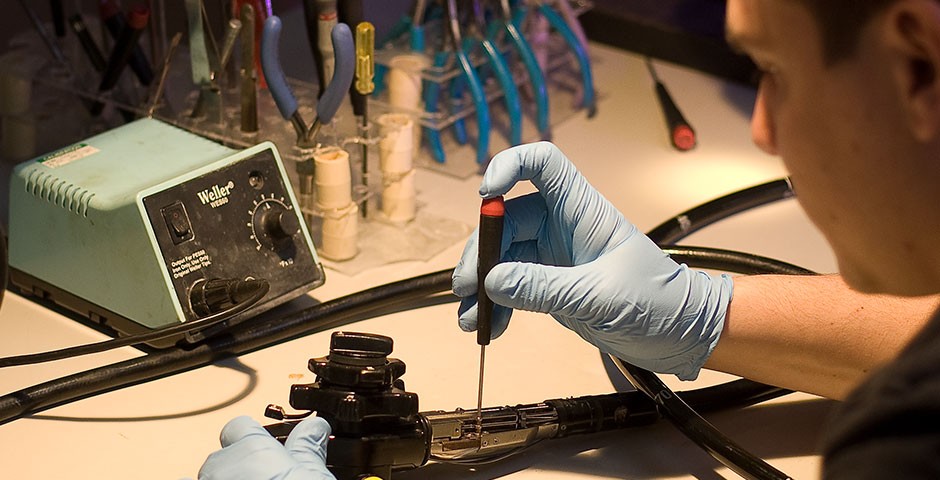

3. Long-term maintenance.

It is critical for providers to note cost is more than a face-value dollar amount. The service component and warranty are hugely important when determining the value of using preowned scopes. “This is where it gets sticky,” says Mr. Smith. “If I have to send a scope back to the OEM that has been worked on by a third-party repair company, and they did not use OEM parts, then [the OEM] will not work on those scopes without replacing those parts.”

That means a provider could pay for replacement parts two times over. When they sign the ISO contract, providers need to ensure it includes service and maintenance functions and the device is covered by a warranty. Providers should require their repair vendor to honor the OEM warranty. Keeping in mind the risk of highly specialized issues that require OEM repair, providers need to ensure the value of the entire ISO contract is still worth the price.